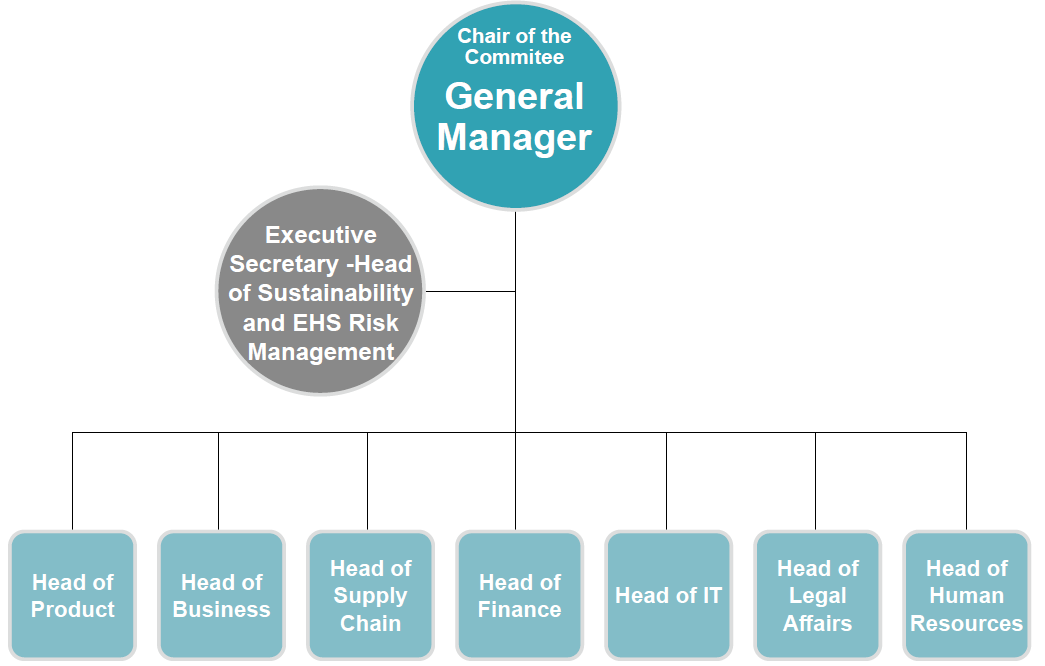

The Risk Management Committee (RMC) is supervised by the Board of Directors and the Audit Committee and is responsible for overseeing the Company’s risk management. Chaired by the General Manager, with the Chief Human Resources Officer as Executive Secretary and department heads as members, the RMC meets every six months to discuss material risks and related control measures. It aims to establish a proactive risk management mechanism that enables timely responses to risk events, mitigates or avoids impacts, and ensures effective management of operational risks across all aspects, thereby supporting the Company’s sustainable operations.

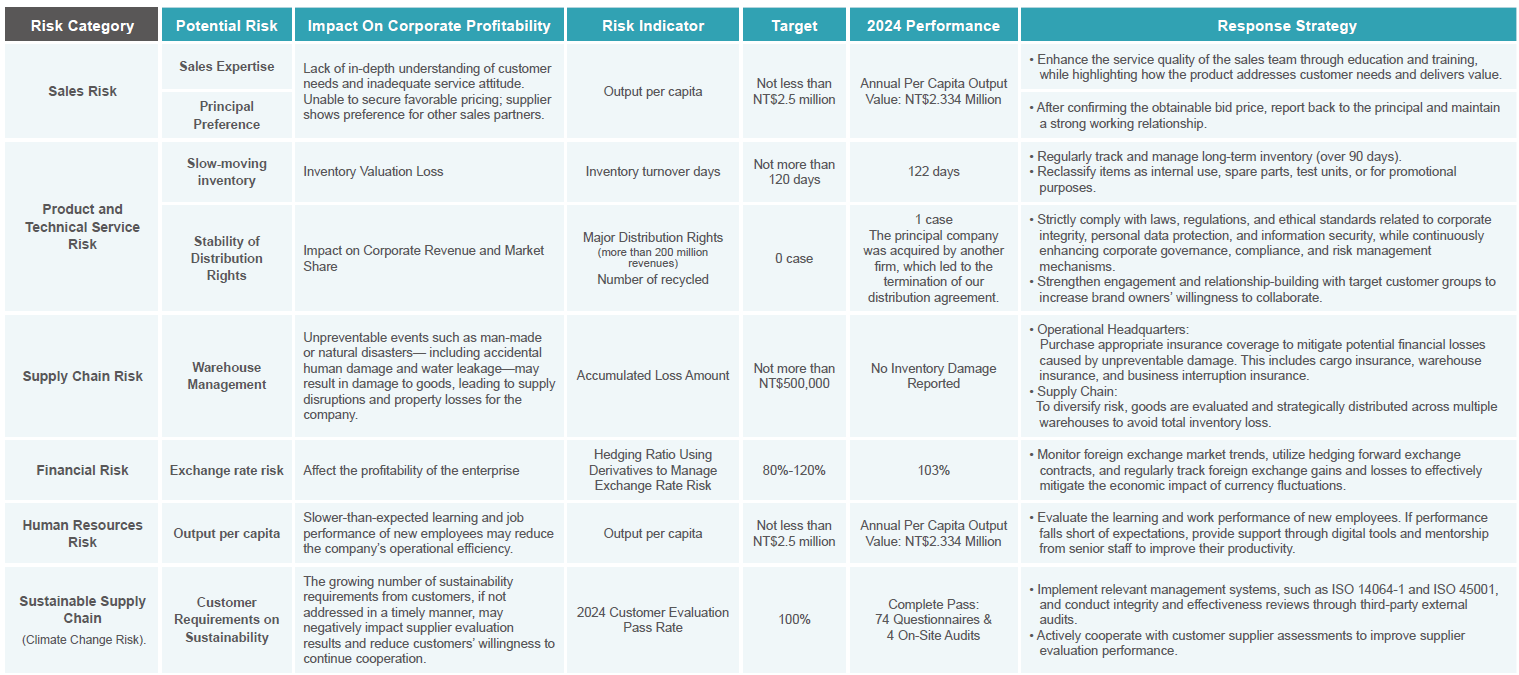

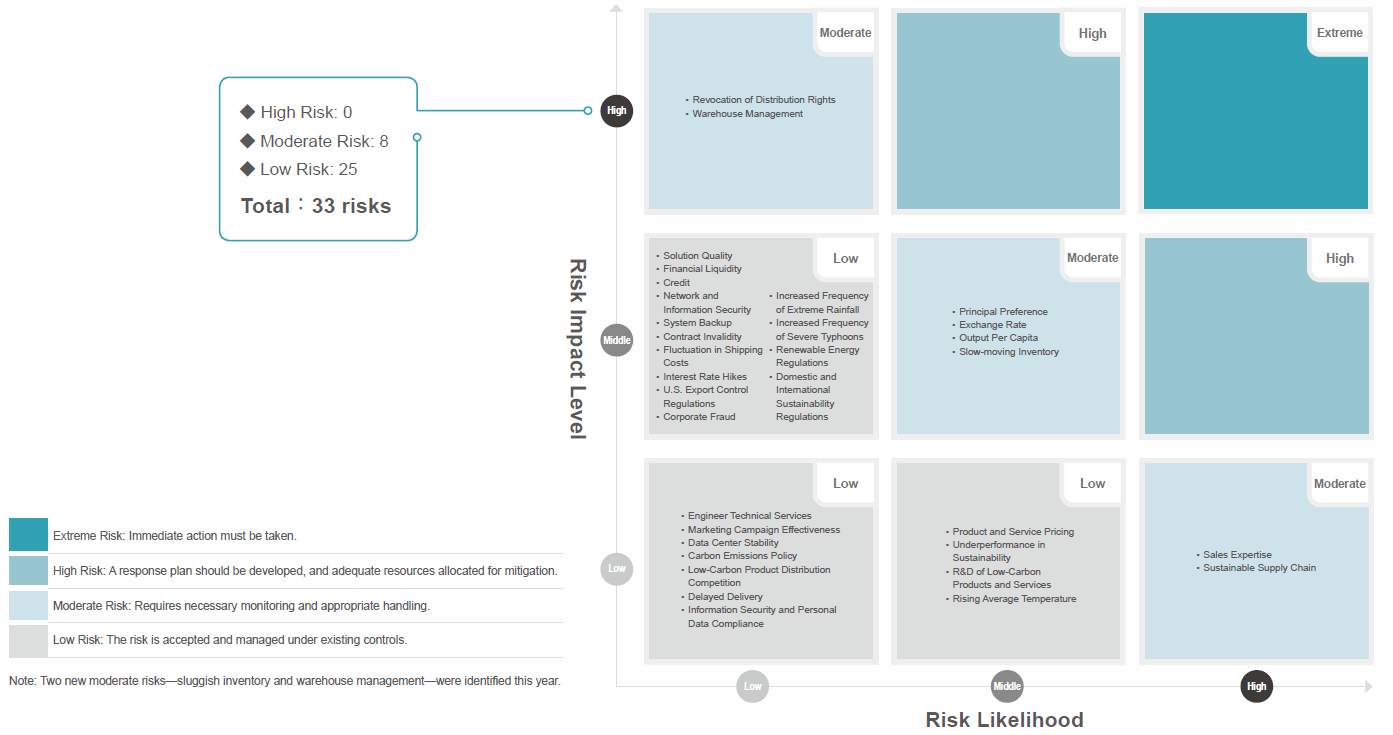

MetaAge categorizes risks into eight areas: sales, product and technical services, finance, information security, compliance, human resources, climate, and supply chain. A total of 33 potential risks are identified under these categories. The Company evaluates risk levels using specific indicators, regularly reviews the risk management framework, and formulates response strategies and control measures. The status and progress of the RMC’s activities are reported to the Board of Directors annually.

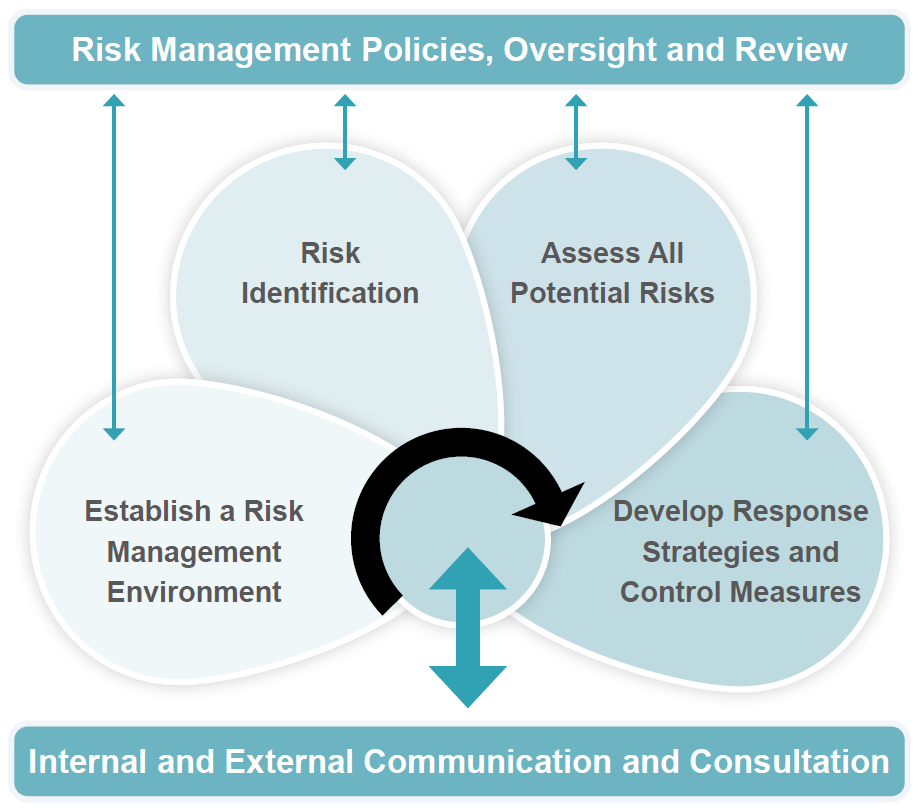

MetaAge identifies and assesses all potential risks through its risk management procedures and develops corresponding strategies and control measures to mitigate or prevent potential impacts from risk events.

The company formally established the Risk Management Committee on August 5, 2011, and held its first risk management initiation meeting on November 29 of the same year. Annually, in the first quarter, the company reports to the board of directors on the operations and business content related to the Risk Management Committee, including risk categories, potential risks, impacts on corporate profits and losses, risk tolerance, response strategies, and the status of risk control measures taken. The 2023 risk management operations were approved by the board of directors on February 29, 2024.

The 2023 risk management operations were as follows:

The Risk Management Committee of MetaAge compiles risk checkup items sorted out by respective units after discussions, including risk category, potential risks, impacts on corporate gains and losses, and response strategies as well as risk control measures adopted. The following items have been assessed as medium-level risks: